Private debt jest alternatywnym źródłem

finansowania przedsiębiorstw

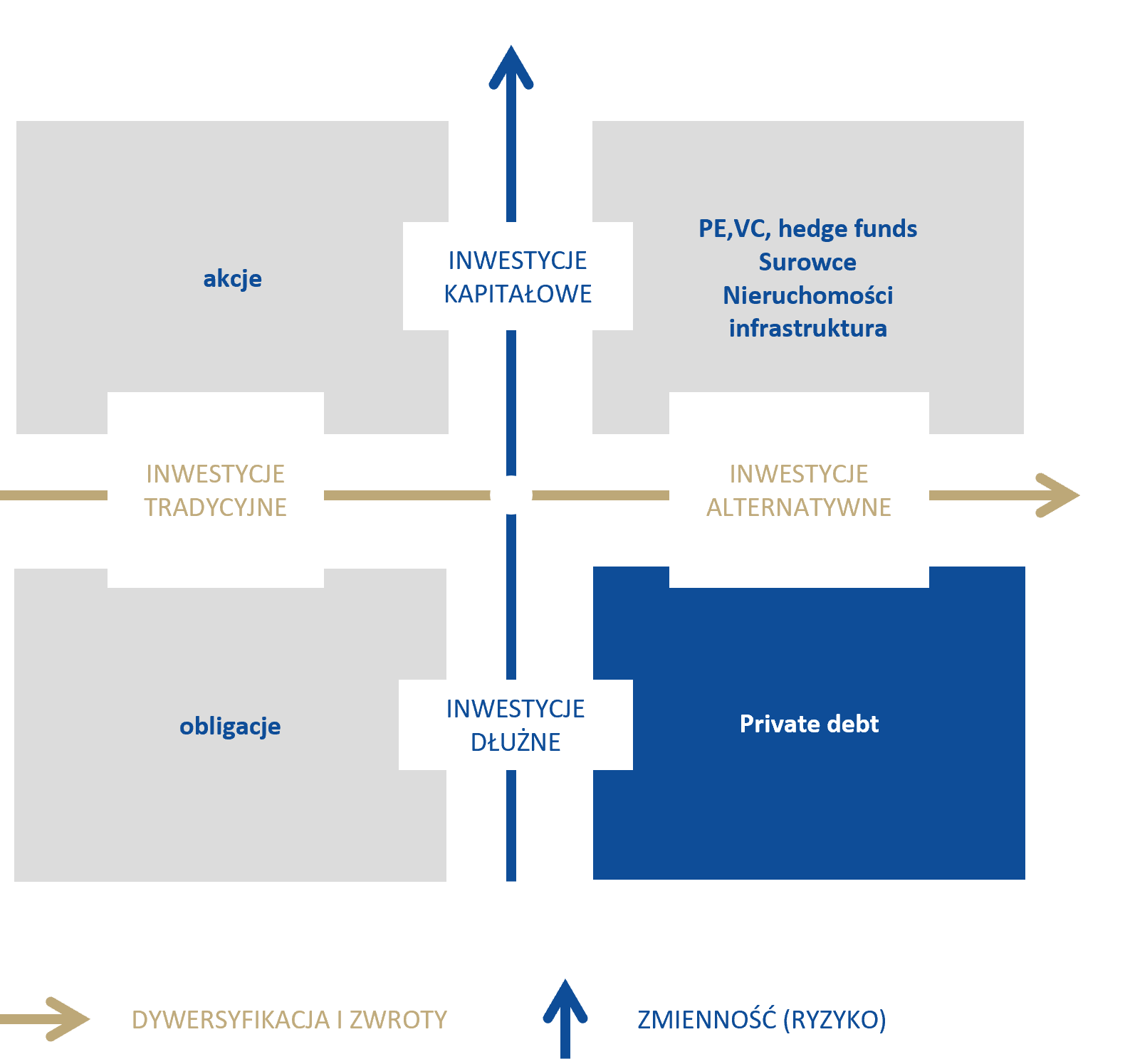

Tradycyjne i alternatywne klasy aktywów

Kluczowe cechy finansowania private debt

Finansowanie pozabankowe

Dług prywatny pojawił się jako odpowiedź na lukę w finansowaniu MŚP spowodowaną przez coraz ostrzejsze wymogi kapitałowe dla banków.

Umowy dwustronne o większej elastyczności strukturalnej

Warunki finansowania dostosowane do konkretnego projektu, uwzględniające specyfikę interesów emitenta i wierzyciela. Znacznie szybszy proces uzyskania finansowania w stosunku do standardowej polityki kredytowej banków.

Wyższa dochodowość z finansowanych projektów

Inwestycje na rynku private debt zwykle oferują możliwość generowania wyższej dochodowości ze względu na premię za niską płynność oraz elastyczność i szybkość w uzyskaniu finansowania.

Silna ochrona wierzycieli

Elastyczne podejście do zabezpieczeń oraz kowenantów finansowych i niefinansowych zapewniające inwestorom odpowiednią ochronę przed ryzykiem kredytowym.

Aktywny nadzór nad spłatą finansowania przez cały jego okres

Pełna kontrola i komunikacja z finansowanym podmiotem umożliwiająca szybką reakcję na potencjalne problemy ze spłatą.