Private debt is an alternative source of

financing of enterprises

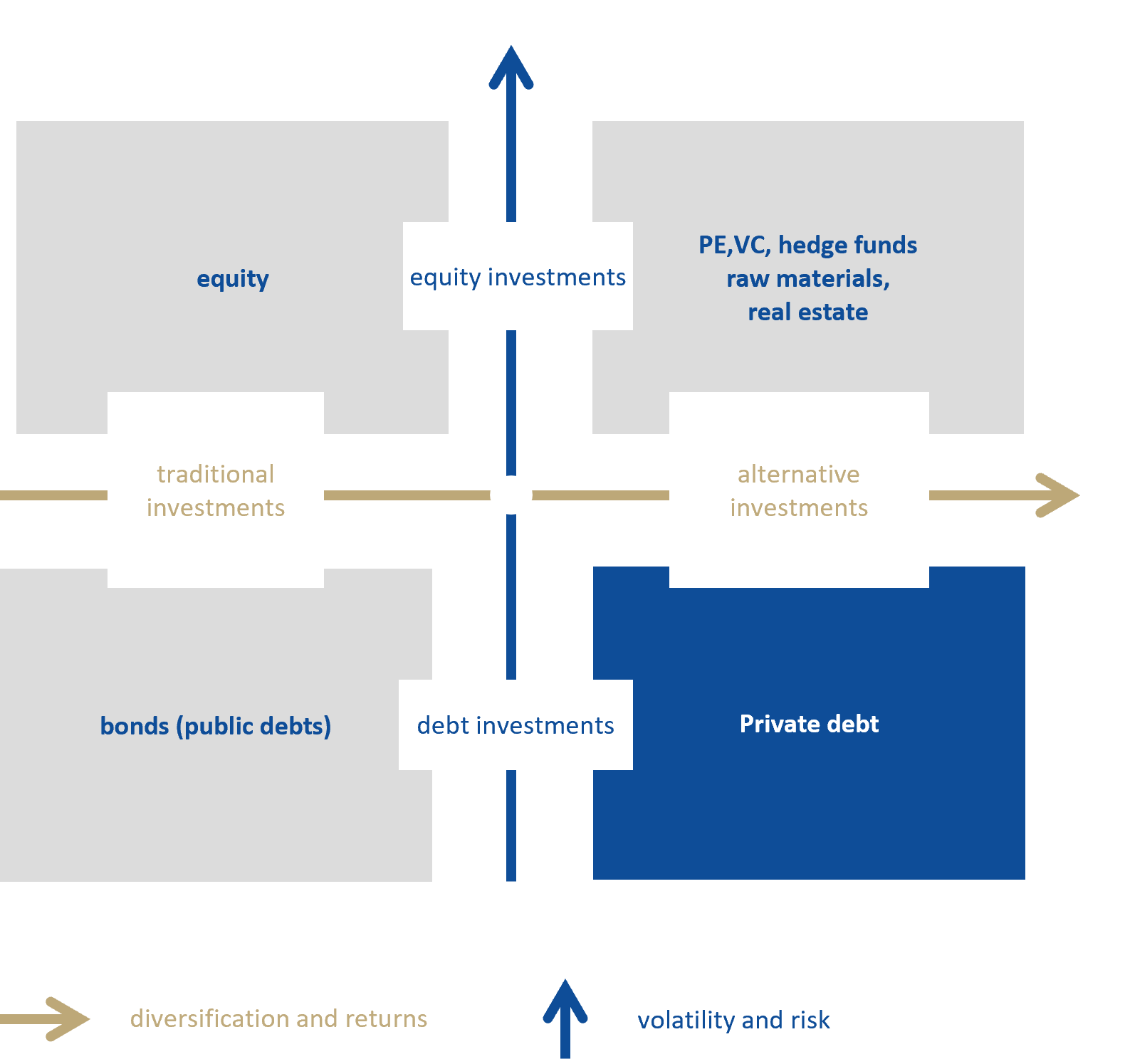

Traditional and alternative asset classes

Key features of private debt financing

Non-bank financing

Private debt has emerged as a response to the SME financing gap caused by increasingly stringent capital requirements for banks.

Bilateral agreements with greater structural flexibility

Financing terms tailored to a specific project, taking into account the specific interests of the issuer and the creditor. Much faster process of obtaining financing compared to standard bank lending policies.

Higher profitability from funded projects

Investments in the private debt market usually offer the opportunity to generate higher yields due to the premium for low liquidity and the flexibility and speed in obtaining financing.

Strong creditor protection

Individualised approach to collateral and financial and non-financial covenants to ensure that investors are adequately protected from credit risk.

Active monitoring of the repayment of the financing throughout its term

Full control and communication with the financed entity enabling a quick response to potential repayment problems.