How can we help?

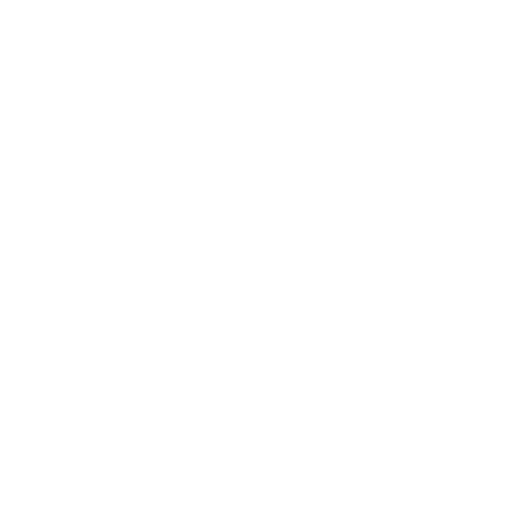

We solve a wide spectrum of capital needs for companies

We provide individually tailored solutions

- We invest from EUR 2 to 20 million

- The cost of capital depends on the transaction risk

- We have an investment horizon of up to 5 years (exceptionally up to 7 years)

- In the case of private equity investments, we are looking for minority packages with a strong partner

We offer various financial instruments

- Our offer includes a wide range of financial instruments, from debt to private equity

- Instruments offered: senior debt, subordinated / junior debt, unitranche, mezzanine, restructuring instruments, convertible debt and private equity

We address a wide range of capital needs

- We support companies in the implementation of the following needs : financing of working capital, new investments (capex), acquisitions, buyouts of shareholders, refinancing of existing debt, dividend payments, financial restructuring

We provide financing for various industries

- We invest in various industries including: financial services, industrial goods, trade and services, health care, consumer goods, real estate, technologies, media and telecommunications, transport and logistics, hotels and leisure, energy

We support companies from Central Europe

- We invest in companies from the entire region (over 700 projects analysed annually)

- We have made investments in 9 countries of the region

- We have a network of international industry experts and advisers

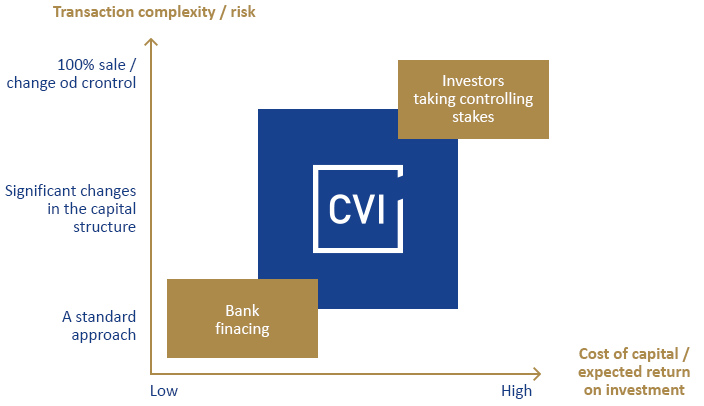

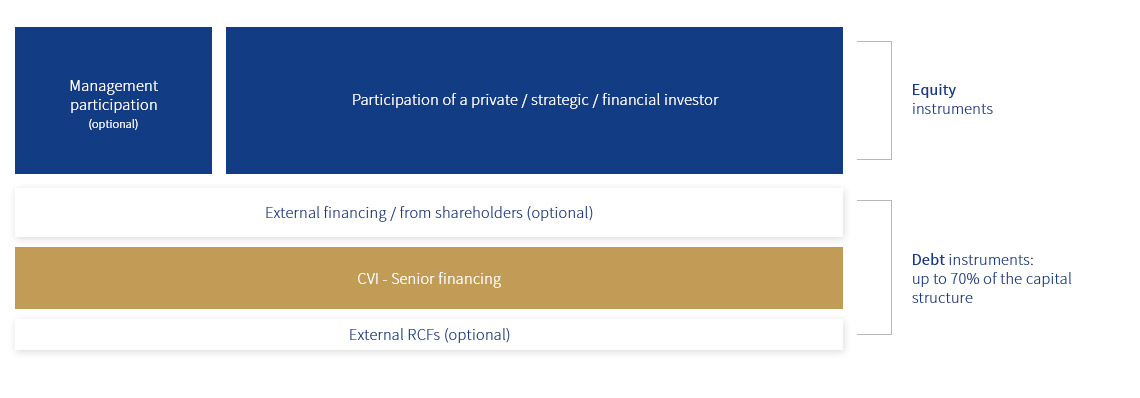

We offer diversified financial instruments

- We are a partner that enables flexible adjustment of the company’s financial structure.

- We work with private, financial and industry investors.

- We have the capital and appropriate tools to analyse each situation in an individualised way.

Senior debt

- An alternative to bank financing that is characterised by flexibility and speed (on average 3-10 weeks until the funds are available)

- Senior debt can be used for investments, acquisitions of enterprises or simply to strengthen working capital in times of rapid business growth

- Financing is available to companies with strong business model and regular cash flows

- Repayment of the invested amount is possible over time or all at once at maturity. The latter option allows the company to retain cash for other uses, such as capex or working capital

- Typically, the funding period does not exceed 5 years

- The company’s assets may serve as security for the financing

Junior debt

- Financing provided in addition to other types of financing, mainly bank financing

- This debt is junior in terms of repayment and collateral in relation to other financing entities

- It allows the company to finance further business development without the need to find external equity investors and change the ownership structure

- Junior debt can be used for investments, acquisitions, strengthening working capital, paying dividends or purchasing own shares

- It offers flexibility of payment service that allows the company to capitalise a portion of the interest expense (a “payment-in-kind” structure)

- The source of repayment (usually up to 5 years) is operating cash flows, with the possibility of repayment at the end of the financing period

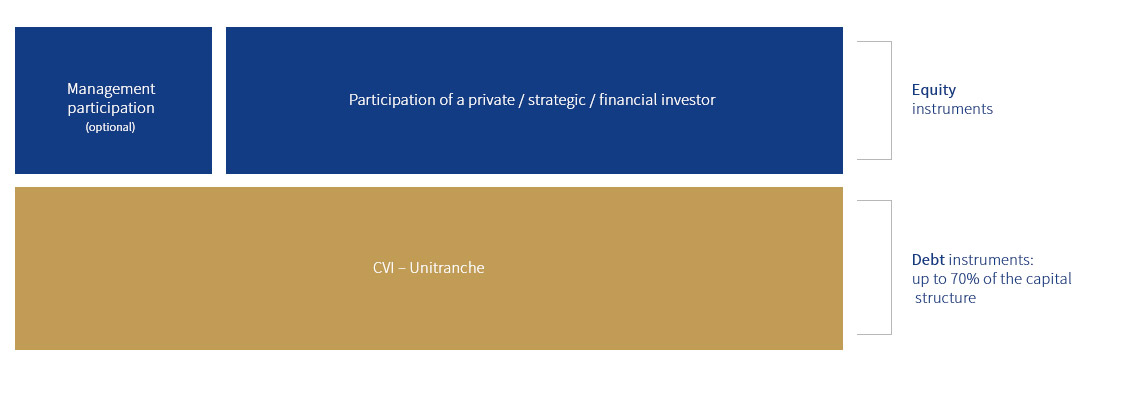

Unitranche

- The perfect solution when more debt is needed than is available from banks/traditional senior debt providers. It allows the company to incur senior and junior debt in a single financing, provided entirely by CVI

- It facilitates the process of obtaining financing for new projects or optimising the existing financial structure

- It allows the company to replace many various forms of financing with one reliable partner and one solution

- Unitranche can be used to refinance existing liabilities, to finance takeovers, working capital increase or recapitalisation

- Repayment takes place from current cash flows over a period of up to 5 years in instalments or as a bullet payment at maturity

- Financing is typically secured by the assets and shares of the financed company

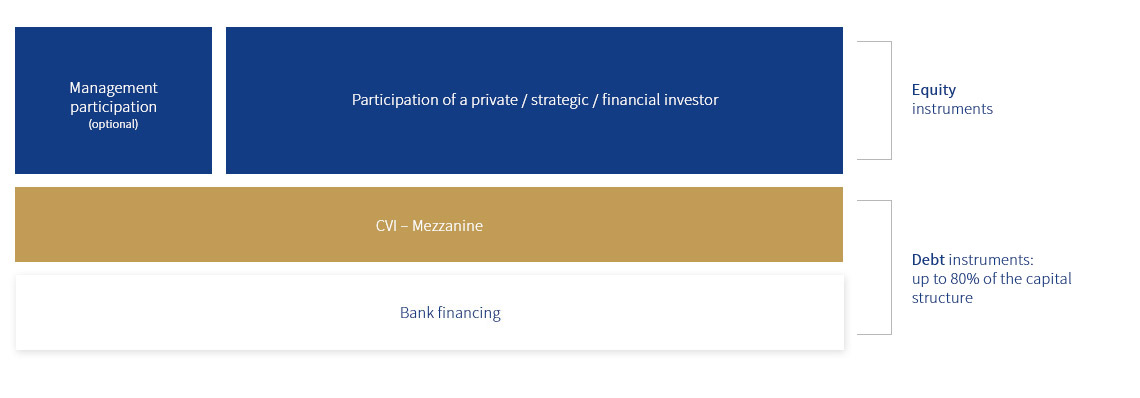

Mezzanine

- The most flexible type of financing offered by funds managed by CVI

- It allows for accepting risk beyond senior/junior debt financing. The company will typically not be able to repay the debt from its own cash flow but will need to refinance it at maturity

- This financing is usually provided for up to 5 years

- It serves such purposes as investments, acquisitions, buyouts, recapitalisation, restructuring or project financing

- It is allowed to partially capitalise interest (a “payment-in-kind” structure) and repay the full amount at the end of the financing period

- It is also possible to include a variable compensation mechanism depending on the performance of the company, such as warrants or similar instruments

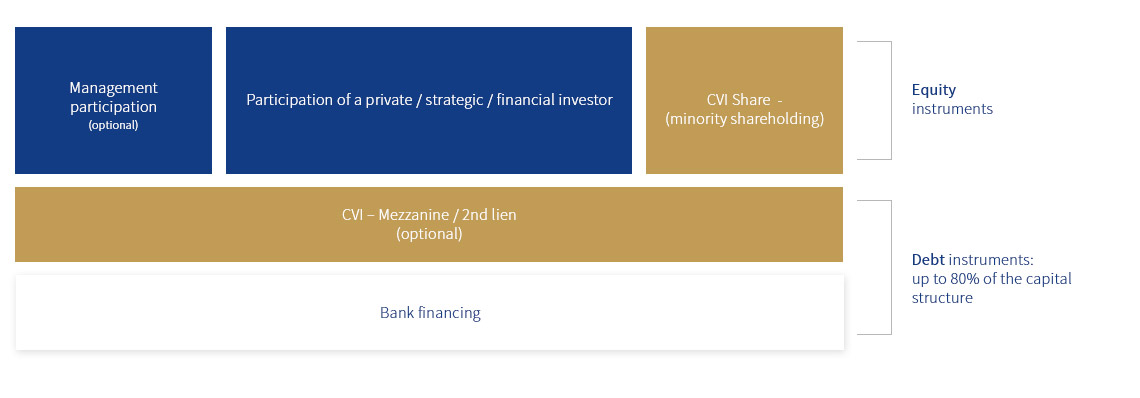

Convertible debt and private equity

- The funds managed by CVI can also invest in debt convertible into equity or directly in the equity of a particular company

- In the case of direct investments into capital (such as “private equity”), we usually have minority stakes, leaving operational management of the company in the hands of majority shareholders

- We have an investment horizon of 3 to 5 years and expect an agreement on the proposed exit path

- Equity financing can also be combined with mezzanine or junior financing

Special situations and restructuring

- The funds managed by CVI can also provide financing for entities in a difficult liquidity situation or undergoing restructuring

- The available collateral plays a key role in these transactions

- CVI is able to engage in comprehensive restructuring processes, for example by buying debts from other financing providers or suppliers who want to release their funds without waiting for the restructuring process to succeed

- In such cases, financing can be provided by the funds managed by CVI in the form of debt or private equity and is always individually tailored to the respective situation